Why Should You Care About Bitcoin? (Part 2)

As always, some great resources are included at the end of this article if you want to dig even deeper.

Enjoy! 🧡

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

The whole world is talking about Bitcoin and everyone seems to have an opinion.

So why should you care?

We'll break it down for you into two sections:

- Selfish reasons

- Moral reasons

Selfish Reasons

In this section, we'll cover:

- Bitcoin as an Investment: Why bitcoin will get more valuable over time

- Bitcoin Protects You: How bitcoin shields you from the coming CBDCs

- Bitcoin is Inevitable: Why bitcoin is inevitable and you should learn about it

Bitcoin as an Investment

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy.”

–Satoshi Nakamoto, 2009

Let's be clear: Bitcoin is far more than just an investment. However, one of the most common reasons people first get involved in Bitcoin is to make money! So in this section, we'll cover why it still has long term investment value.

"Number Go Up" Technology

The price of bitcoin will likely continue to rise over time because of its fixed supply cap, programmed halving cycle, and multi-layered exponential network effects (we'll cover these characteristics below).

Meanwhile, other assets such as stocks, bonds, real estate, oil, art and gold have at least one of the following shortcomings: (1) infinite potential supply, (2) centralized supply manipulation, or (3) counterparty risk. As a result, value invested in these assets tends to "bleed" into bitcoin over time as investors realize these problems and migrate to bitcoin as a safe haven.

The total number of bitcoins that will ever exist is 21 million. This is hard coded into the bitcoin protocol. Importantly, you don't have to take our word for it! Bitcoin does not rely on a central authority. Instead, you can verify and enforce all the rules of Bitcoin along with anyone in the entire decentralized Bitcoin network just by running a node on your computer!

The bitcoin mining reward is halved every 210,000 blocks (~4 years). Just like the supply cap, this "halving cycle" is hard coded into the protocol and cannot be changed. With global adoption of bitcoin occurring exponentially, each halving event therefore dramatically increases the price of bitcoin because increasing demand is chasing decreasing supply:

As outlined in our first article What is Bitcoin? there are many reasons to think bitcoin is far more valuable than gold because anything gold can do bitcoin can do better.

As of the time of writing, bitcoin's market cap is ~$370 billion or roughly the size of Exxon Mobil. Meanwhile, gold's market cap is north of $11 trillion. Back of the napkin math: With the current circulating supply of 19.08 million BTC, if bitcoin captured just one quarter (1/4) of gold's market cap it would be worth ~$144,000, which is 8x its current price. If bitcoin matched gold's current market cap it would be worth ~$576,000, which is 30x its current price. If Bitcoiners are right and it's worth more than just the market cap of gold, then the sky is the limit.

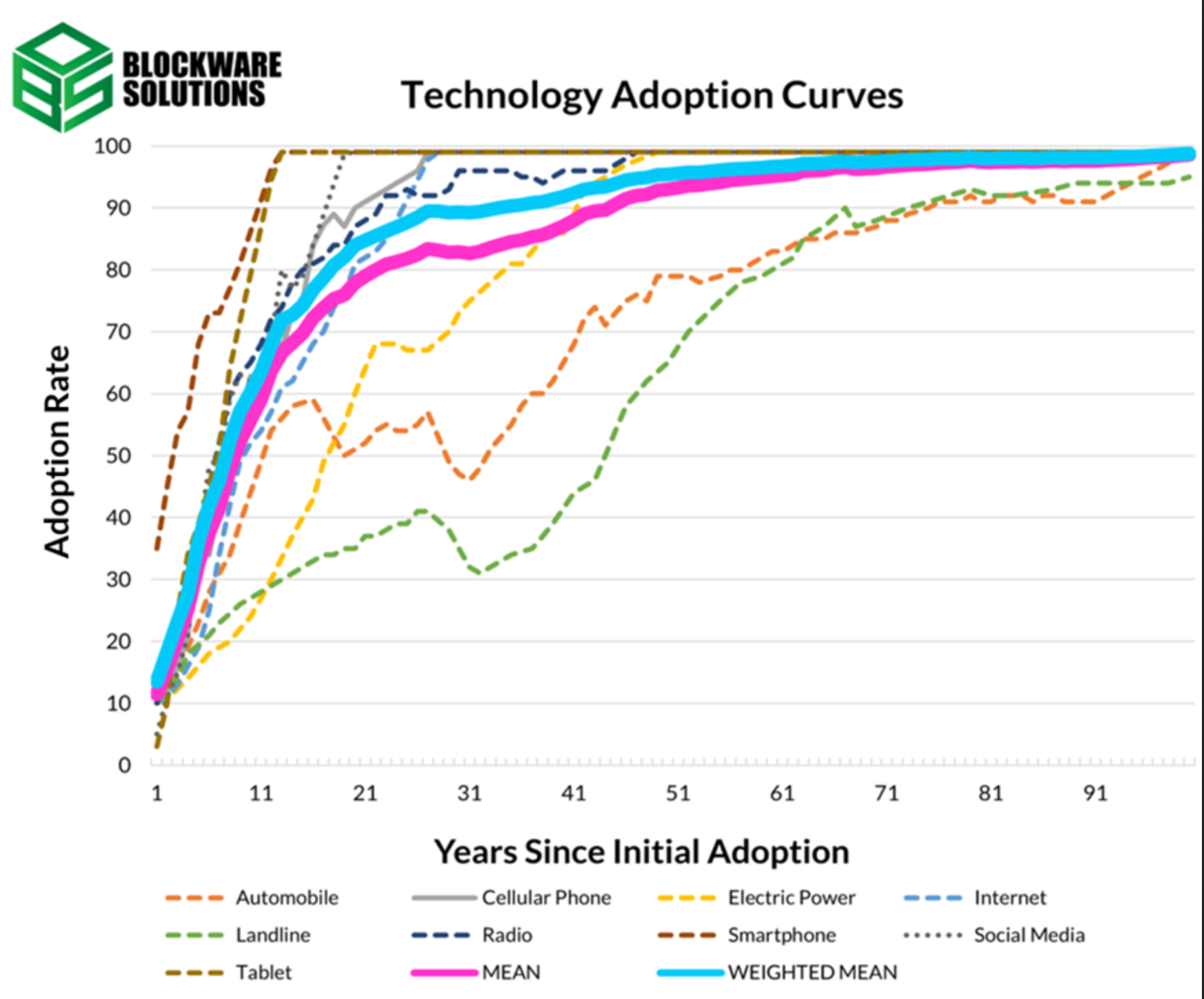

The pace of bitcoin adoption is exponential. Human brains are wired to understand linear processes so we struggle to comprehend exponential growth. But unlike other exponential technologies (think: cell phones, the Internet, radio, etc.), you can actually buy a share of Bitcoin as it goes through its exponential growth phase! This has often taken decades for other technologies:

These characteristics combine to create the "Number Go Up" phenomenon Bitcoiners know and love, a term popularized by Saifedean Ammous.

Bitcoin Protects You

As technology advances all around us and cryptocurrencies capture the world's attention, banks and governments are trying to keep up. For them, one of the key risks posed by bitcoin is that it enables users to "opt out" of the fiat monetary system and be truly financially independent of state authority.

We must mitigate the illicit finance and national security risks posed by misuse of digital assets.

...

The United States derives significant economic and national security benefits from the central role that the United States dollar and United States financial institutions and markets play in the global financial system.

– U.S. President Joe Biden, White House Executive Order on Ensuring Responsible Development of Digital Assets, 2022

Threats Posed by CBDCs

In an attempt to retain control, governments are developing their own centralized digital currencies known as Central Bank Digital Currencies (CBDCs). In doing so, they are (perhaps unintentionally) waging war on self-sovereignty. CBDCs accomplish one thing: they allow governments to have more direct and extreme financial control and surveillance over citizens.

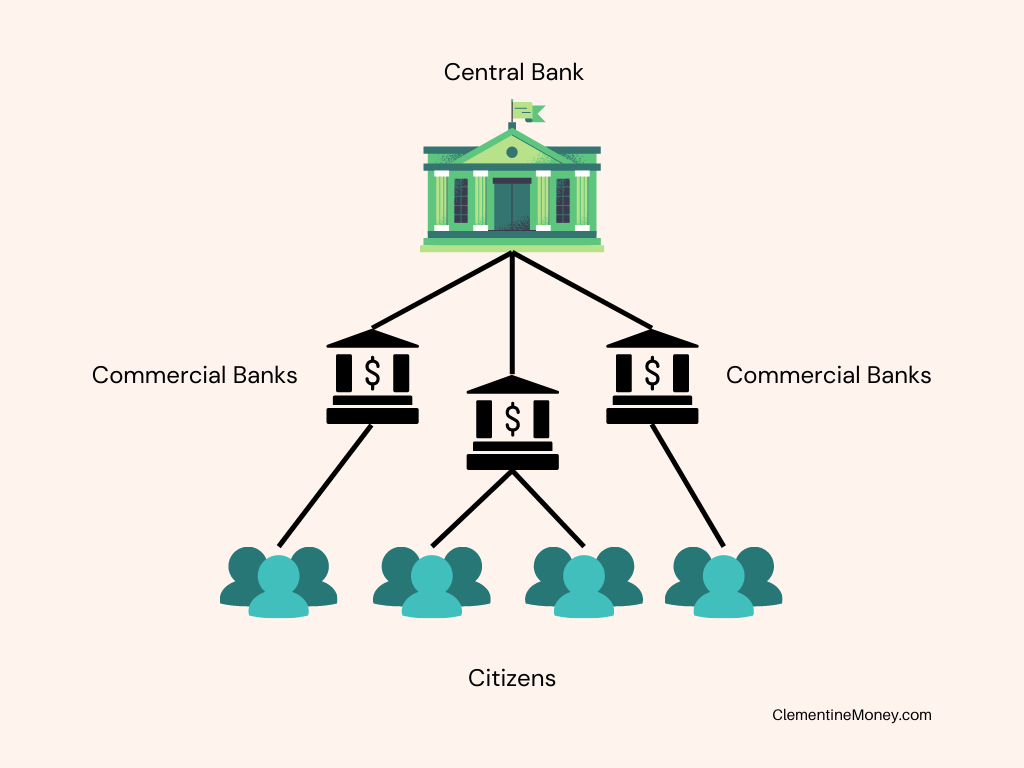

In today's fiat systems, central banks (think: European Central Bank, Federal Reserve, Bank of Japan, etc.) maintain a ledger of money from commercial banks (think: Bank of America, Santander Bank, J.P. Morgan Chase, etc.), which in turn maintain a ledger of money from citizens:

CBDCs would make commercial banks and cash largely unnecessary, because they would enable governments to issue money directly to citizens through a centralized digital ledger. Below are some of the reasons this would be disastrous for individual freedoms.

Personalized Inflation

Today, while inflation is a major problem around the world, it affects more or less everyone to some extent. CBDCs would allow governments to personalize the monetary policies applied to each citizen. Imagine a future in which anyone deemed "criminal" by the State can be punished by having their personal savings systematically devalued with the click of a button.

Financial Censorship

Today, while governments can force big commercial banks and platforms to blacklist individuals for criminal activity, this still requires legal hurdles and coordination by corporations to be effective. In contrast, CBDCs will allow governments to target individuals or groups and directly deactivate their money without warning. Imagine checking your phone one day after protesting online and finding the following email from a government agency:

"Our records indicate you donated $100.00 to the Freedom Protest last month. As a result and in accordance with federal law, this $100.00 has been deactivated. You have until the end of this month to spend your most recent paycheck of $1,500.00 on eligible purchases before it expires."

Social Credit Systems

Today, your purchases made with credit cards are not very private because credit card companies collect data on what you purchase and sell that data to other institutions. However, CBDCs will be far worse for privacy because every purchase you make will be instantly known by the centralized authority controlling the ledger, namely the central bank and the government controlling it. As a result, CBDCs will be an invaluable tool for governments that intend to implement social credit systems to control the behavior of citizens. See China for chilling examples.

In all, CBDCs have the potential to be one of the largest infringements upon human rights in the history of modern civilization. While today's fiat currencies are far from perfect, CBDCs would take all of their flaws––centralization, infinite supply, poor privacy, and slave-master architecture––and amplify them even further.

Bitcoin is the Escape

Thankfully, Bitcoin is our way out of the CBDC nightmare. This is not meant to imply that Bitcoin was created because of CBDCs. Instead, the opposite is true! CBDCs are being created by powerful governments as a terrified reaction to what Bitcoin promises to individuals: unstoppable property rights, freedom from centralized control, and guarantees of financial access and inclusion. Fiat currencies are a sinking ship of hyperinflation, debt, war, and inequality.

Bitcoin is the life boat.

Bitcoin is Inevitable

If the above reasons aren't compelling to you, consider that Bitcoin will inevitably affect you some day whether you care about it or not. So why not learn about it?

Think of the Internet in the 1990s. That's where we are today in terms of the global understanding of what Bitcoin is, how it's different from other cryptocurrencies, and why it will inevitably grow in use and value over time. In 1999, some estimates showed that ~248 million people worldwide used the Internet. Similarly in 2021, estimates showed that only around ~106 million people used or owned Bitcoin globally.

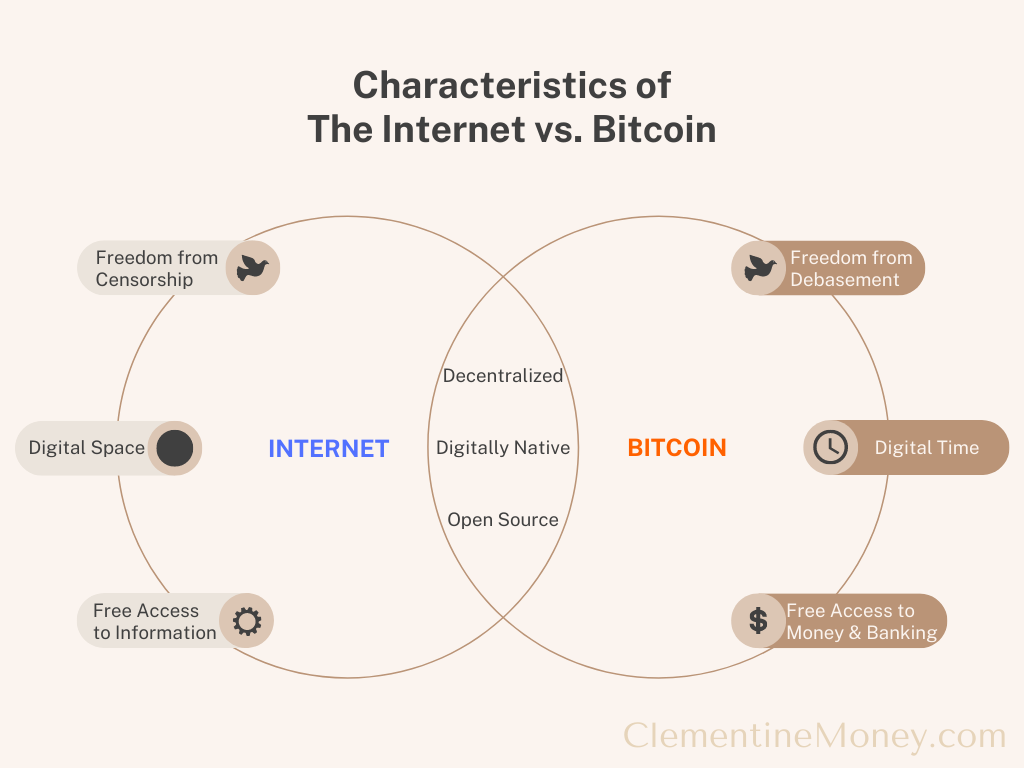

Why did the Internet explode into every corner of every industry we know today? Simply put: because of its anti-fragile design characteristics mirrored by Bitcoin:

term popularized by Nassim Taleb to describe systems or phenomena that gain strength from disorder, such as Bitcoin

Bitcoin is tearing down the obstacles to financial inclusion. Billions of people now have free access to digital banks they can keep in their pockets. Bitcoin dematerializes the entire banking system the same way the Internet dematerialized newspapers, books, and record players. But it's also so much more. Bitcoin is a platform, just like the Internet. It is a world of possibility upon which worlds will be built that we can't imagine today, no more than those in the 1990s could imagine Facebook.

What would you do if you could go back in time to that decade, knowing how big the Internet would be in the future? It's worth spending time to understand Bitcoin because, just like the Internet, there will be a day when it affects everyone everywhere, directly or indirectly. Understanding how it works, why it works, and the endlessness of its potential, is worthwhile and useful for everyone.

Moral Reasons

In this section, we'll cover:

- Bitcoin is Clean Magic: How bitcoin is backed by peace and free code

- Bitcoin Can Save the Environment: How bitcoin monetizes renewables

- Bitcoin is Essential for Human Rights: Why bitcoin protects freedom

Bitcoin is Clean Magic

Recall the 'Pear Cups' case study from Part 1 of this article:

"You pick up your phone, open an app, click some buttons, and voila! Pears in a cup, delivered to your doorstep by an Amazon drone the same day. Magic."

This, we said, is actually Dirty Magic because of all the hidden costs associated with producing that plastic pear cup and transporting it across the globe. But what would Clean Magic look like? What if you could pick up your phone, open an app, click some buttons, and have a real, homegrown, all-natural pear fall out of the sky right into the palm of your hand?

Enter: Bitcoin

Similarly covered in Part 1, we outlined how fiat money is also Dirty Magic because of its hidden environmental and human costs. Fiat money is backed by oil, war, and inflation.

Unlike fiat money, with Bitcoin all the work, energy and infrastructure involved in getting you what you want is built with and backed by free open source code and peaceful computer processing. When you take out your phone, download a free open source bitcoin wallet app, write down 12-24 words (your private key) on a piece of paper, and then send/receive bitcoins over the Bitcoin blockchain... that's Clean Magic.

By using bitcoin, you are effectively participating in a globally connected community garden of monetary value run over the blockchain. Everyone in the world has access to this garden and can grow value in it whenever they want. Instead of water and sunshine, bitcoins need time and electricity to grow. These bitcoins are real, natural, and homegrown, and with the click of a few buttons on your phone, you can participate in this natural garden of value right now.

But... Isn't Bitcoin Mining Wasteful?

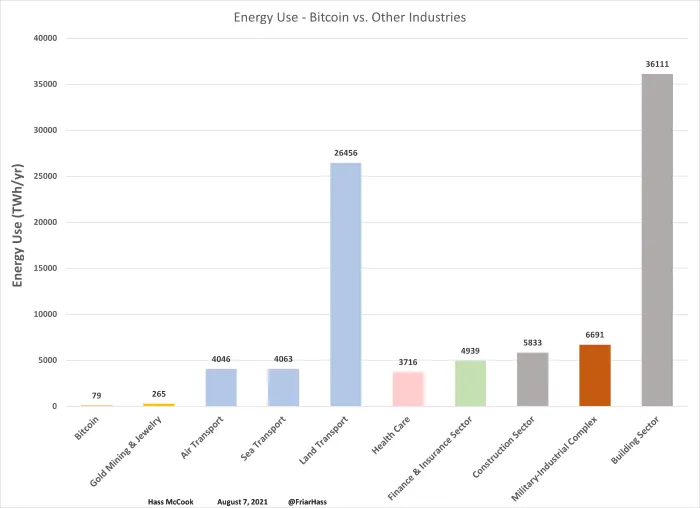

The most common and misguided criticism of Bitcoin is its energy use. As we covered in What Is Bitcoin? the large upfront cost of mining known as 'proof of work' secures the network by making it nonsensical for miners to attempt to cheat. However, this amount of energy use by the Bitcoin network is small and peaceful, especially relative to the energy requirements of fiat money. And compared to other industries around the world, the energy use of Bitcoin is a drop in the bucket.

Published in Bitcoin Magazine, The Questionable Ethics of Bitcoin ESG Junk Science by Level39 does a great job of outlining why Bitcoin is so often attacked in the media and by politicians over its energy use, and why these attacks are disingenuous and harmful to the aims of real environmentalism.

"ESG researchers are able to profit, by leveraging the media to stoke public outrage, over what amounts to such an inconsequential amount of carbon emissions that actual environmentalists should be disturbed that the public’s attention is being distracted from larger issues that have real and substantial consequences for humanity."

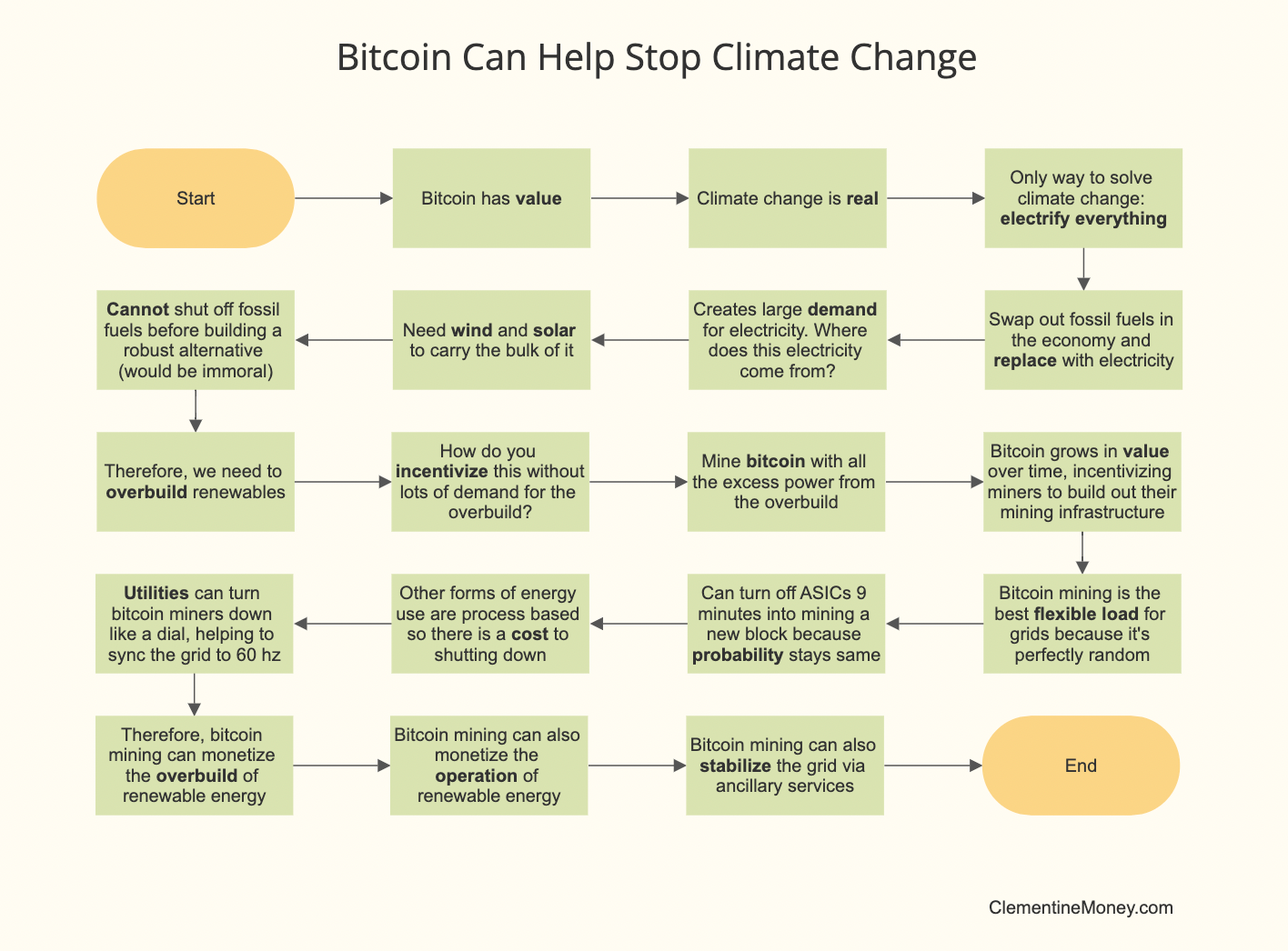

Bitcoin Can Save the Environment

In contrast to the claims of popular news outlets relying upon the flawed sources referenced in the above article, bitcoin has the potential to revolutionize energy grids and help drive a renewable transformation that could help curb climate change.

While you can get more information from this podcast, in summary, thanks to bitcoin's uniquely interruptible process design, bitcoin mining is an ideal flexible load for grid operators, which is vitally needed to make energy grids renewable at scale.

Additionally, bitcoin mining is currently one of the greenest industries on the planet, conservatively estimated at ~60% renewable globally.

"...by embracing the Bitcoin Network and bitcoin mining, the United

States of America will be more innovative, economically resilient, and ultimately stronger into the future."

– Bitcoin industry leaders in an open letter to the EPA, 2022

Bitcoin is Essential for Human Rights

Access to money is a fundamental human right, NOT a privilege.

The world we live in today treats it as a privilege with governments, banks, and institutions as the gatekeepers. All around the planet, the rich are rewarded with easy access to the strongest currencies and cheap credit with no questions asked.

Meanwhile, the poor who need money most are locked out of the financial system by corrupt banks and politicians. Nearly 1.7 billion adults are unbanked globally, and the total figure including teenagers and younger is much higher. Those unfortunate enough to be born into the wrong countries or families are treated as less than human by being enslaved to the inflationary whims of central banks and by being forced to rely upon predatory commercial banks and intermediaries that charge exorbitant fees for basic monetary functions.

Over 4 billion people live under authoritarianism. For these people, Bitcoin is a lifeline rather than a speculative investment. With nothing but 12-24 English words in their heads, they can attempt to flee oppressive regimes in search of a better life. Bitcoin gives everyone access to the fundamental human rights of wealth protection and frictionless value exchange, regardless of race, color, religion, gender, age, or sexual orientation.

Summary

Why should you care about Bitcoin? Selfishly, you should care because: (1) It can grow your wealth over time while fiat money devalues, (2) It can protect your privacy and freedoms while fiat systems devolve into surveillance dystopias, and (3) It is inevitable anyway so learning about it now can put you ahead of the curve.

Morally, you should care because: (1) Bitcoin is clean magic backed by free and peaceful open source code while fiat money is backed by oil, war, and inflation, (2) Bitcoin mining can help save the environment by monetizing a renewable energy overbuild at scale, and (3) Bitcoin gives everyone on the planet free access to the fundamental human rights of wealth protection and frictionless value exchange.

Share on Twitter

TweetFollow @clementinemoneyAdditional Resources

- [Report] Bitcoin Investment Thesis by Fidelity

- [Report] Q1 2022 Report by Bitcoin Mining Council

- [Letter] Letter to the EPA by Various Contributors

- [Essay] The Bitcoin Dilemma by Alex McShane

- [Video] Cryptoeconomics - 3.4 - Bitcoin: Game Theory by Cryptoeconomics Study

Translations

🇩🇪 German Translation by Simon Satoshi

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

Member discussion