What is Bitcoin?

If you want to dive a little deeper into the complexities of Bitcoin, we've included some great resources at the bottom of this article to help!

Enjoy! 🧡

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

The word Bitcoin can refer to one of two things: the network or the asset. When you hear people talk about bitcoin on the news, they're often talking about the price of bitcoin (₿) the asset (abbreviated "BTC" on exchanges). Other times you may hear people say Bitcoin is decentralized or that it uses a lot of energy. In these cases, they are referring to the Bitcoin network.

the characteristic of having no central authority or point of failure, but rather a distributed network of participants, all with equal control.

Part 1: The Bitcoin Network

The Bitcoin network consists of three basic parts:

- Users

- Nodes

- Miners

Users

Anyone who buys or sells bitcoin (₿) the asset is a user of the Bitcoin network. Users are important for bitcoin because they determine its price, or value, by trading it with each other. They also create liquidity for bitcoin and help to give it credibility in financial markets.

the degree to which something is in high supply and demand, making it easily convertible to cash.

My Picasso painting is not very liquid as it would take me months to sell it. Bitcoin on the other hand is convertible to cash at any moment, making it a very liquid commodity.

Just by buying bitcoin (₿), you become a user of the network!

Nodes

Any computer that runs the Bitcoin Core software is a node in the Bitcoin network. Nodes are important for Bitcoin because they validate transactions and blocks and communicate them to one another in real time. They also keep a complete history of the bitcoin ledger which can be audited by anyone in the world at any time. This software is written with open source code that anyone can verify and it can be run on an average laptop. By following the simple set of rules defined by the code, nodes create consensus with one another about the truth of past transactions.

the log of all transactions in the history of Bitcoin, which defines ownership of all bitcoins at all times.

Just by running this code at home, your computer becomes a node in the network!

Miners

Any node that bundles transactions together into blocks to add to the Bitcoin blockchain is a miner in the Bitcoin network. Miners are important for Bitcoin because they secure the network from attacks and theft. First, they "mine" for bitcoins by guessing trillions of numbers as quickly as possible until they find one that solves a difficult cryptographic puzzle. Then, once they find an acceptable answer to the puzzle, miners are allowed to add their block to the network and receive a reward of freshly minted bitcoins for their efforts.

the distributed ledger shared among Bitcoin nodes, organized into chronologically timestamped bundles of transactions known as blocks.

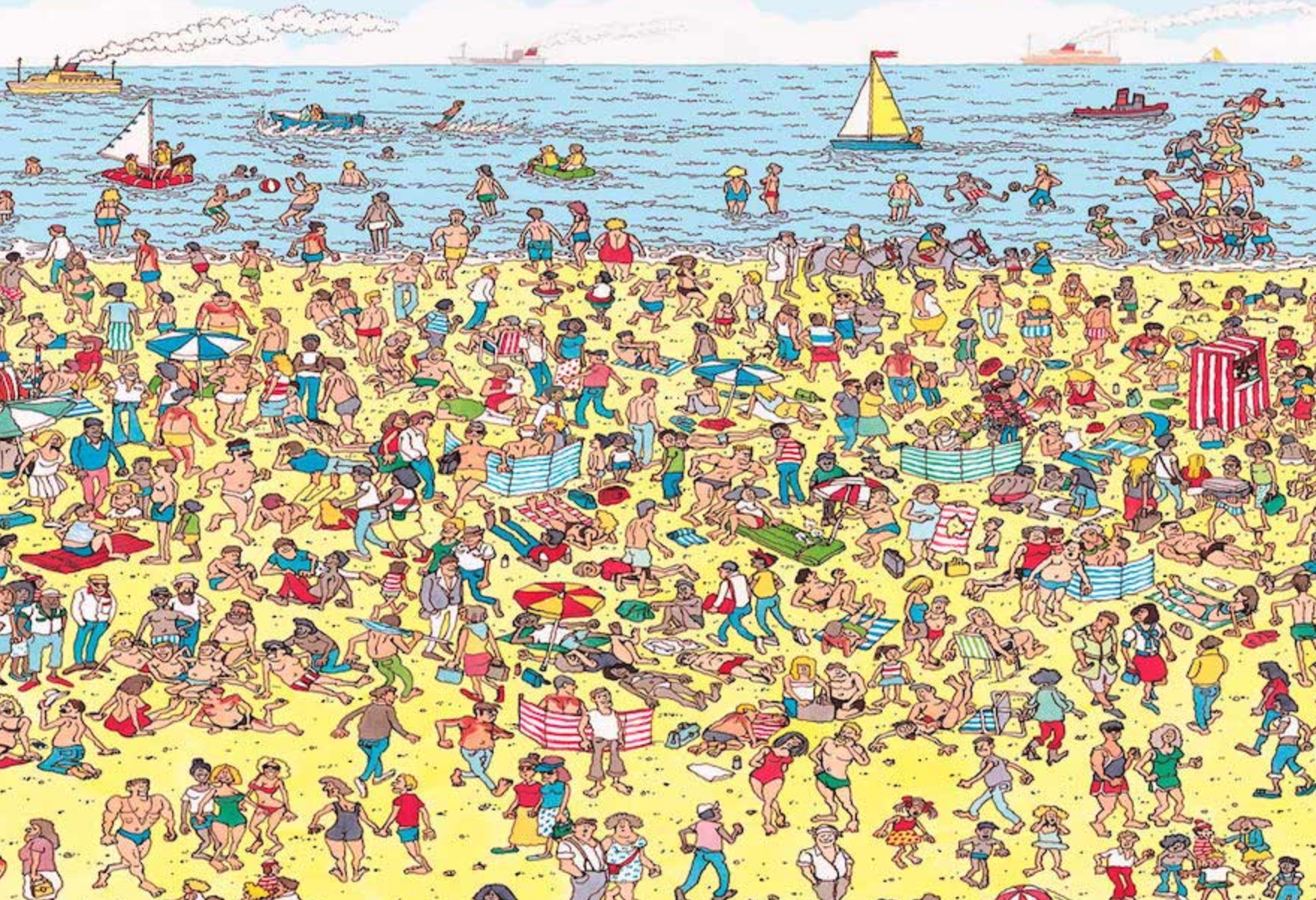

This puzzle is very difficult but once solved it's trivially easy to verify the solution. Similarly, in the popular children's book "Where's Wally", you (the reader) try to find a character named Wally in a crowded picture. You are shown what Wally looks like ahead of time so validating his identity once found is easy. If your friend finds Wally before you and points to him on the page, you don't need to trust your friend is telling the truth because you can just check if the answer is valid yourself.

This process of spending time and energy to search for an answer is known in Bitcoin as "work". And it's a lot of work! Mining is an expensive business because normal computers are too slow to guess trillions of numbers quickly enough to compete with other miners. These days, mining profitably can only be done with specialized computers called ASICs, which typically cost thousands of dollars to purchase, store, and maintain. These units also guzzle large amounts of electricity, which is not cheap. As computer chip technology improves over time, these ASICs need to be replaced with more powerful machines in order to remain competitive. Running a profitable mining business can cost millions of dollars.

After all that upfront work, once you find an answer to the cryptographic puzzle you can present your block to the network along with your answer as "proof" that you put in the work to find a valid solution. In Bitcoin, this is called proof of work.

a form of cryptographic proof in which one party (the miner) proves to others (the nodes) that a certain amount of a specific computational effort has been expended. Nodes can confirm this expenditure with minimal effort on their part.

If a miner tries to cheat by including fake transactions to artificially enrich themselves, other nodes in the network will quickly see the miner did not find a valid solution to the puzzle and will reject the block. When the block is rejected, the miner's coinbase transaction never gets processed so they never receive their precious BTC reward. Now all those thousands of dollars spent on mining equipment and electricity are lost––and they miss out on the BTC reward too!

the first transaction in a block. Miners include it to collect the block reward for their work. As of now (2022) this reward is 6.25 BTC but the Bitcoin network is programmed to cut the reward in half roughly every 4 years with the next halving set to occur in 2024.

If it were cheap and easy to mine bitcoins and update the Bitcoin ledger, that would leave Bitcoin vulnerable to theft. Miners would be incentivized to cheat because even if they got caught they could just try again for minimal cost. This is why the difficult process of mining (proof of work) is crucial for Bitcoin's security.

Summary

The Bitcoin network orchestrates a careful dance between users, nodes, and miners to achieve decentralized consensus about all past bitcoin transactions. In contrast to normal fiat currencies, this creates a system in which no central authority unilaterally updates the monetary ledger. Instead, the right to update the ledger is like a lottery contest and anyone in the world can verify it's working according to the rules just by running a node, which can be done on any old laptop. The large upfront costs associated with mining help to prevent fraud and ensure all miners perform the vital role of validating and updating the blockchain honestly.

currency that is not backed by any commodity such as gold or silver, and typically declared by a decree from the government to be legal tender.

Part 2: Bitcoin The Asset

"Bitcoin is currently transitioning from the first stage of monetization to the second stage. It will likely be several years before Bitcoin transitions from being an incipient store of value to being a true medium of exchange, and the path it takes to get there is still fraught with risk and uncertainty. It is striking to note that the same transition took many centuries for gold. No one alive has seen the real-time monetization of a good (as is taking place with Bitcoin), so there is precious little experience regarding the path this monetization will take."

– Vijay Boyapati, The Bullish Case for Bitcoin (2017)

Bitcoin's Monetary Properties

Why would anyone find value in imaginary Internet money? Well, it turns out there are several characteristics of money that most people naturally find to be valuable and bitcoin scores well in most of these categories when compared to other forms of money. Below are 5 of the most important monetary properties.

1. Scarcity

Bitcoin has a hard supply cap of 21 million coins. This is perhaps the most important pillar of bitcoin. Because there is no central authority in control of the money supply, bitcoins cannot be printed at will, unlike fiat currencies such as the US dollar ($). Instead, new bitcoins are created for miners (detailed above) as rewards for organizing transactions into blocks. The size of this reward is cut in half on a predetermined schedule of every 210,000 blocks (which works out to roughly every 4 years). This ensures that bitcoin's supply is known at all times. In contrast, nobody knows exactly how many US dollars exist today.

Overall Grade: A+

2. Fungibility

Bitcoin users value each bitcoin the same as any other. While the Bitcoin network sees no functional difference between any two bitcoins, it is possible for governments, exchanges, and even miners to attempt to censor certain bitcoin addresses. This is because the entire blockchain is transparent and visible to anyone in the world. These threats may lessen over time as Bitcoin continues to evolve. Recent protocol implementations such as Schnorr signatures and second layer solutions like the Lightning Network have already dramatically improved the privacy and fungibility of bitcoin.

Overall Grade: B

3. Durability

Bitcoins do not deteriorate over time. Unlike ancient forms of money such as seashells, beads, and minerals, bitcoins are just information. They are digitally native and do not wear down or "lose their shine" over time. This makes them highly effective at storing value as they can be held indefinitely with no impact on their value whatsoever.

Overall Grade: A+

4. Divisibility

Bitcoins are divisible down to a hundred millionth of a bitcoin. The smallest unit of bitcoin is known as a satoshi, named after Bitcoin's pseudonymous creator Satoshi Nakamoto. This unit of bitcoin is very small, allowing for 8 decimals (1 satoshi = 0.00000001 of 1 bitcoin). This is far more divisible than any fiat currencies used around the world today.

Overall Grade: A+

5. Portability

Bitcoins can be transported easily through space and time. Because bitcoin is just information, it is as easy to transport as information. In fact, you could carry around the equivalent of billions of US dollars' worth of bitcoin in your head anywhere in the world just by memorizing 12 to 24 English words. This makes bitcoin the most portable money ever and a lifeline for millions around the world looking to escape authoritarian regimes and war-torn countries without having their wealth confiscated.

Overall Grade: A+

The Bitcoin Roadmap

As other forms of money did, bitcoin will evolve gradually over time as its use cases change. In 2022 at the time of writing, bitcoin is still volatile with 50-80% drops not uncommon. However, before the latest bitcoin reward halving in 2020, its price used to swing up and down more often. As bitcoin matures and becomes more widely adopted around the world, it may follow a similar blueprint to other monies that came before it.

Stage 1: Collectible

In 2009, as a brand new currency known only by cypherpunks in a small corner of the Internet, bitcoin could have been aptly described as merely a collectible. It was so relatively unknown by the world that it had practically no exchange value. In a now infamous illustration of this, in 2010 Laszlo Hanyecz spent 10,000 bitcoins at Papa John's to buy himself two pizzas. The transaction totaled $40, while today those same bitcoins would be worth over $250 million!

an individual advocating widespread use of strong cryptography and privacy-enhancing technologies as a route to social and political change.

Stage 2: Store of Value

The term "digital gold" began to catch on as a narrative about bitcoin as early as 2013 when people started to see the similarities between the monetary characteristics of bitcoin and gold. Both assets score well in the categories of money listed above. However, it soon became clear that when it comes to storing value for long periods of time, anything gold can do, bitcoin can do better.

The ability to store value indefinitely is critical for any money to gain widespread trust and adoption. Bitcoin achieves this particularly well because every aspect of bitcoin is pure information that can be easily stored, transported, or communicated. Bitcoin ownership is forged into the immutable bitcoin blockchain forever and can be unlocked using a private key.

a secret number that is used in cryptography, similar to a password. In cryptocurrency, private keys are also used to sign transactions and prove ownership of a blockchain address.

Stage 3: Medium of Exchange

Until around 2015 when the Lightning Network was first theorized, the potential for bitcoin to be used as a medium of exchange was considered a long shot. Most were quick to point out Bitcoin's average processing time of only 7 transactions per second (TPS). By comparison, Visa claims to process 20,000+ TPS. Bitcoin transactions also take 10 minutes to settle on average and transaction fees don't scale down with the amount of money being exchanged. For example, two people could pay the same $1 mining fee if transacting around the same time, even if one is buying a $5 cup of coffee and the other is sending $1 billion across the globe. For these reasons, many people thought small, daily transactions would never be feasible with bitcoin.

However, in 2017 with the launch of the Lightning Network––a second layer bitcoin scaling solution––bitcoin as a medium of exchange became a reality. Capable of processing 1 million TPS instantly anywhere in the world practically for free, Lightning has revolutionized bitcoin. Today, just five years later, the Lightning Network has grown exponentially in size and is used by merchants all over the world to accept small bitcoin payments.

Stage 4: Unit of Account

As bitcoin becomes more widespread, people in developing nations with unusable national currencies that have lost value due to hyperinflation may begin to use bitcoin as a unit of account in their daily lives. This means they will start to think about the value of every day items in terms of bitcoins and satoshis rather than dollars. This is already starting to happen in countries like El Salvador and the Central African Republic, both of which have made bitcoin legal tender.

money that legally must be accepted if offered in payment of a debt.

As more countries recognize the benefits of using "unstoppable money" that is cheaper, faster and harder than US dollars, they will gradually follow suit. Younger generations who grow up in these countries using bitcoin to save and transact will begin to think about value in terms of bitcoin and after enough time has passed, this will likely happen in larger, developed nations as well.

Summary

Bitcoin (₿) the asset is the currency of the Bitcoin network. Users give it value by trading it with one another for varying prices. Compared to other forms of money, bitcoin grades well in each of 5 important monetary properties: Scarcity, Fungibility, Durability, Divisibility, and Portability. The path toward widespread bitcoin adoption will likely follow the same stages as past forms of money like gold, a phenomenon we already see playing out before our eyes. Bitcoin will be used as: (1) a collectible, (2) a store of value, (3) a medium of exchange, and finally (4) a unit of account. This monetization process took many centuries to occur for gold, but bitcoin is jumping through these stages at comparative light-speed.

Share on Twitter

TweetFollow @clementinemoneyAdditional Resources

- [Essay] The Bullish Case for Bitcoin by Vijay Boyapati

- [Video] Bitcoin Proof of Work by Ioni Applberg

- [Video] Blockchain 101 Demo by Anders Brownworth

Translations

🇩🇪 German Translation by Simon Satoshi

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

Member discussion